The Selectboard and School Board adopted budgets earlier this week to send to voters at Town Meeting on March 3. Under the Town budget, the municipal tax rate is likely to increase by about 7%. The adopted school budget is projected to increase the homestead school property tax rate by 5.77%.

TOWN BUDGET.

The budget adopted by the Selectboard set total expenditures of $4,441,173, an increase of 3.97%, from last year, not including separate monetary articles. To fund the budget, property tax revenues need to grow by 7.72%.

I do not recall any specific Selectboard discussion relating to the projected municipal tax rate. However, it would seem that the municipal property tax rate will increase by around 7%, as the Grand List does not increase significantly from year to year.

Last year, the Selectboard used $40,000 from the Undesignated Fund Balance to buy down the Town tax rate by approximately one-half cent. A buy down is not likely this year.

What are the significant changes to the Town budget? The Town Manager never provided a written narrative that made the Selectboard packet. Maybe the Selectboard will highlight major changes in the Town Report. One possible wild card is the union negotiations that remain unresolved after two years. Are potential pay increases and back pay factored in the budget?

Note that this year’s other monetary articles include more than the Norwich Public Library and other nonprofits. They include ones for a regional climate coordinator ($30,669.51), a climate emergency designated fund ($40,000), a bridge over Charles Brown Brook ($80,000) and building improvements to reduce fossil fuel use by 15% ($2,054,569.38).

SCHOOL BUDGET.

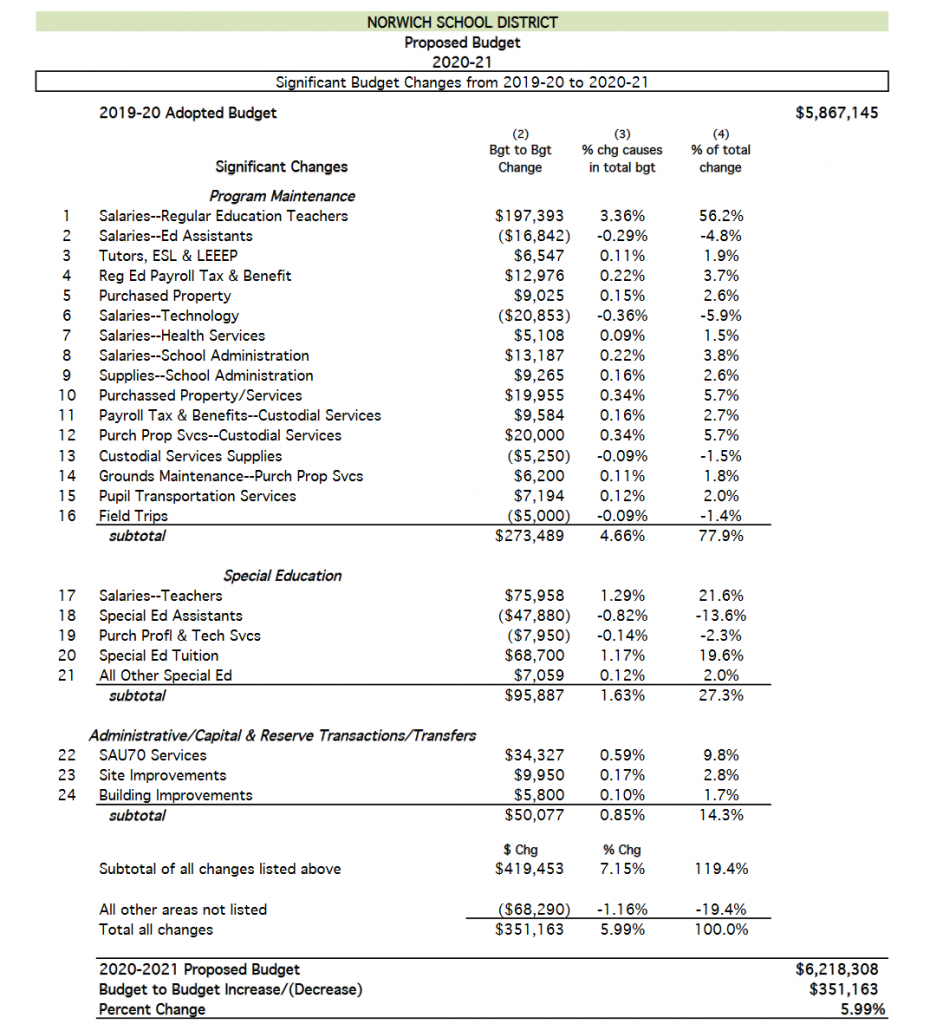

On the school side, the Norwich School Board adopted a budget for Marion Cross School of $6,218,308, an increase of 5.99% from last year. Combined with the Dresden Assessment of $6,757,272, total school expenditures for fiscal year 2020-21 are $12,975,580, an overall increase of 5.03%.

The School District provides a narrative explaining the budget as well as a table of significant changes (excerpt below) Big ticket increases relate to hiring two additional teachers to handle the increasing enrollment at MCS and a nearly $100,000 increase in the Special Education budget.

State law sets school tax rates, with the objective of equalizing the tax burden among school districts across Vermont based on per pupil spending. Norwich spends more than most per pupil, making the homestead property tax rate high. For next year, the projected homestead rate will increase by 10 cents or 5.77%. See tax rate calculation below. The nonresidential tax rate is expected to increase 8.10% but remain less than the Norwich homestead rate. The income sensitivity rate is projected to be 2.92%. The tax rate calculations are preliminary, subject to State legislative changes.

CLA Impact.

One cause for the increase in school property tax rate is the decline in the Common Level of Appraisal (CLA) from over 98% to about 94%. The CLA is an adjustment to Grand List property values to reflect fair market value. The Vermont Department of Taxes does the calculation annually to ensure that “each town is paying its fair share of education property tax to the state’s Education Fund,” says the State’s website. A CLA of 95.89% indicates “that property in the town is generally listed [on the Grand List] for 95.89% of what it is selling for.” See also A Citizen’s Guide to the CLA; Vermont’s Common Level of Appraisal Adjustment for School Taxes, Vermont Children’s Forum and the Public Assets Institute (2006).

Had the CLA remained at 98%, then the homestead property tax rate would have increased by 2.6 cents instead of 10.4 cents. The nonresidential rate increase would have been 6 cents, not 13 cents. The drop in the CLA means Norwich property tax payers pay an extra $500,000 to the State in school taxes, by my calculation.

The CLA in Norwich is likely to continue its downward trend as real estate prices increase. Time for a town-wide reappraisal?

Never miss a new post on the Norwich Observer. Subscribe to my blog by submitting your email address in the subscribe box in the right column. Thanks!