As Town Meeting approaches, the Selectboard has approved a budget, crafted through the dedicated effort of Board members, the Town Manager, and staff. The adopted budget largely aligns with the Town Manager’s proposals.

However, this post does not delve into the intricacies of the budget itself. Instead, it sheds light on issues that emerged during the budget process yet remain unresolved. It’s important to highlight these lingering concerns that warrant attention from the SB and TM, as well as the community. In no particular order, this article highlights several issues of significance.

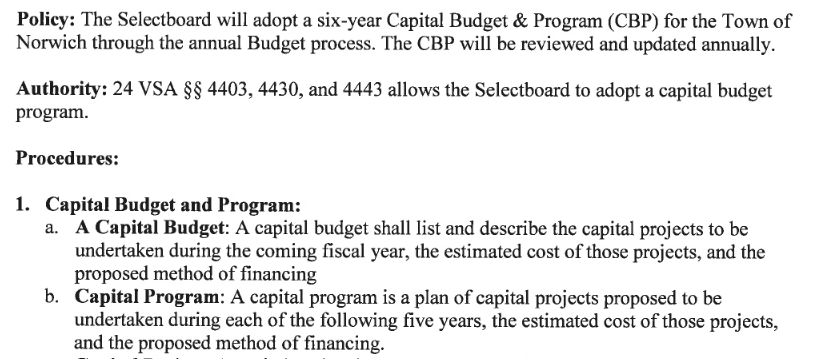

Adoption of Capital plan

“One of the best tools available to meet your community vision and objectives is capital planning,” says the Vermont Municipal Planning Manual. To that end, the Norwich Master Financial Policy calls for the Selectboard to approve a six-year capital plan and to update it every year.

The Selectboard has not approved, let alone updated, a capital plan for some time. However, this year, the Selectboard, with little discussion, adopted the Town Manager’s request to add significant sums to some designated funds, increasing capital allocations for equipment by 128% and for infrastructure by 21%. There was however no capital budget or program presented to or adopted by the Selectboard.

Is it time for the Selectboard to get involved in the capital planning process?

Example: Not planning for walkability

Improving the walkability of Norwich is an example of the need for capital planning to realize the community’s vision of a better and safer Norwich. The discussions at the recent listening sessions held by the Selectboard demonstrate that improving the walkability of the Town is a concept popular with residents and the Board. In addition improved pedestrian and bicycle access is part of the official Town Plan.

Yet, the Town is not settling aside money to fund future walkability projects. And it stopped funding the sidewalk maintenance fund.

To quote a slogan of my local bank when I was a youth: Wishing won’t do it … saving will.

In contrast, during budget season, three Selectboard members (a majority) indicated that redoing the courts is a low-budget priority. However, the proposed budgets allocates $75,000 to the tennis court designated fund, an increase of 650%.

So, why does the designated fund for tennis courts receive $75,000 in the proposed budget and nothing is set aside to fund future walkability projects? I don’t know. However, if money talks, then sidewalks walk.

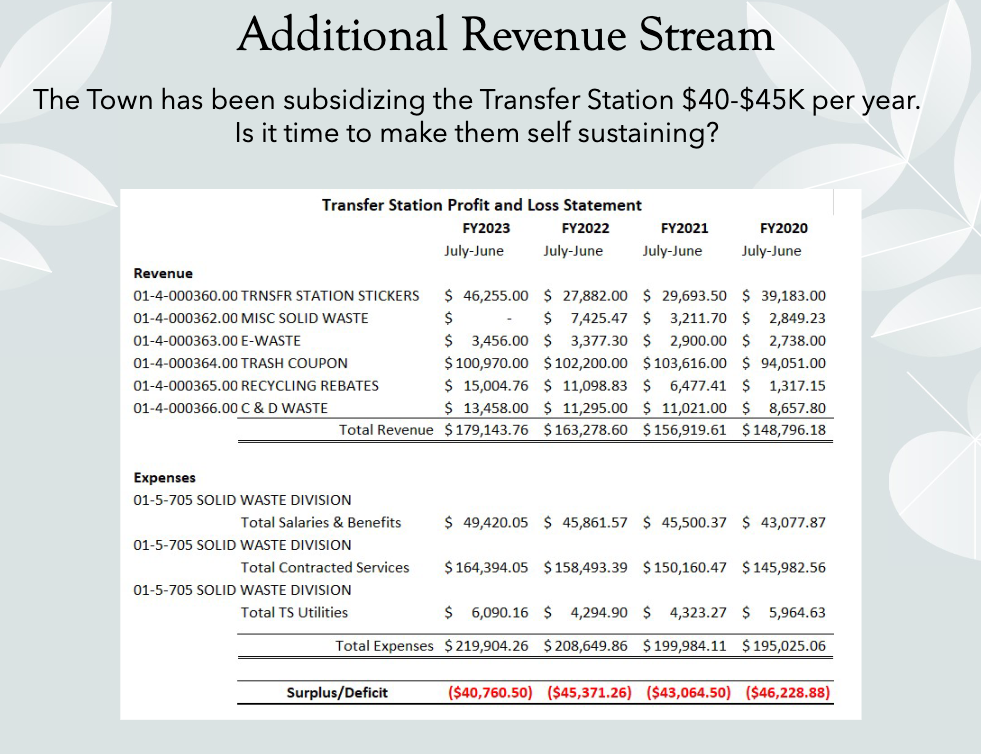

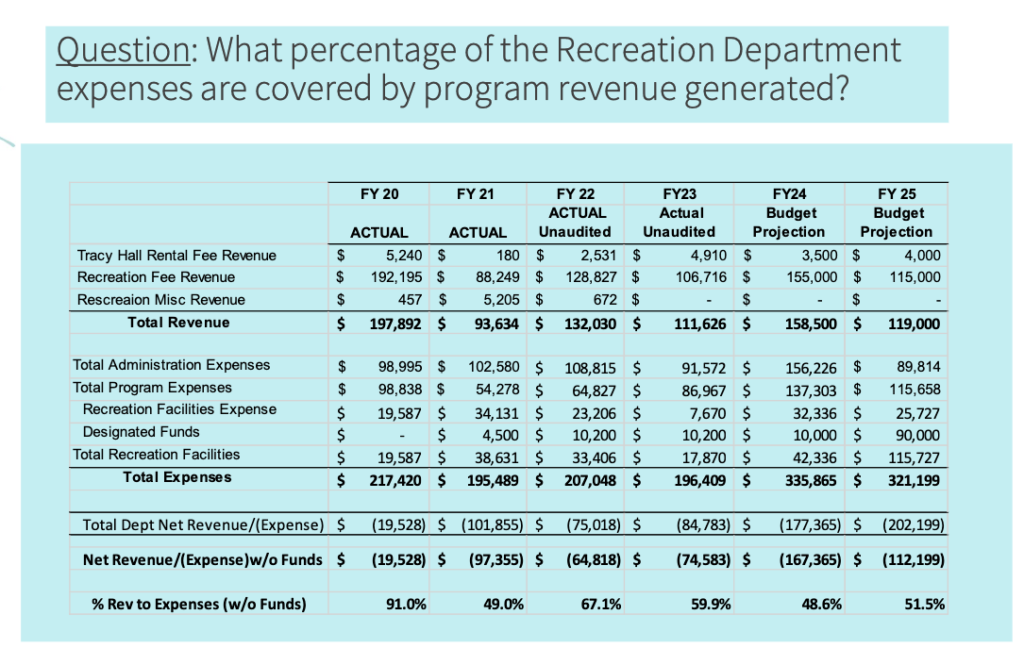

Review of Subsidies to Transfer Station and Rec Department

The Town subsidizes operations at the Transfer Station at around $45,000 per year. In addition, concerning the Rec Department, program revenues covered 91% of program cost in fiscal year 2020 and 78.5% in fiscal year 2017.* In contrast, in the current budget year, program fees are projected to cover about 49% of Rec program costs.

Is it time for the Selectboard to pay closer attention to the revenue side of Transfer Station operations and Rec Department programs?

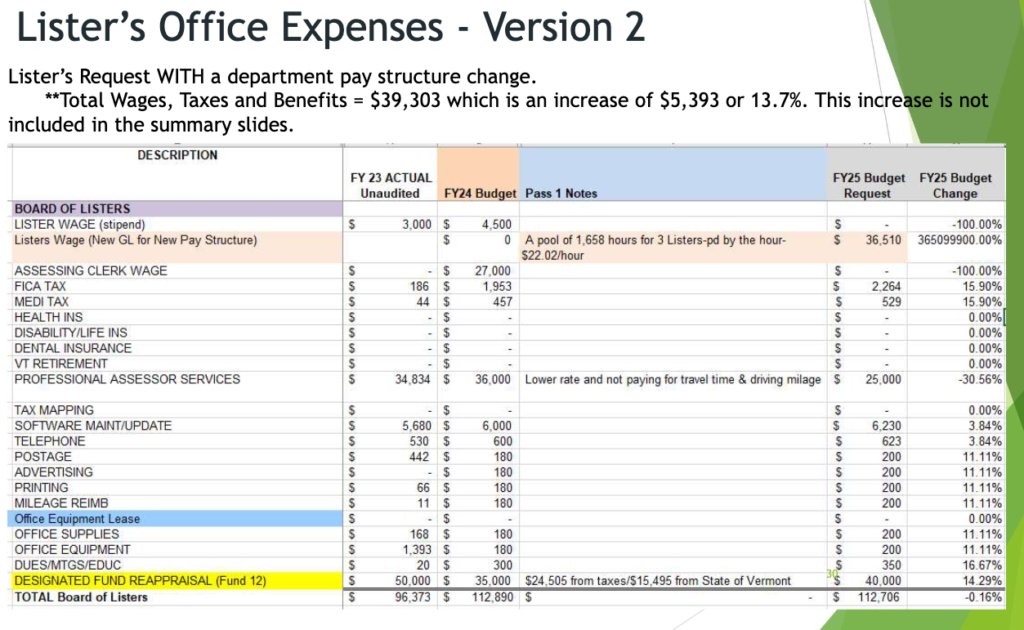

Reorganization of Lister’s Office

The Board of Listers are proposing to reorganize the structure of its office. Members of the elected board would perform the tasks of its clerk and eliminate that position. They would also perform some work previously handled by the professional assessor. For this work, the Town would pay the members at a rate of $22.02 per hour, with hours capped. (The Selectboard minute taker receives $25 per hour.) The Listers say this structure is typical in Vermont and won’t have a material impact on its budget. Nevertheless, the Listers are seeking Selectboard approval of the reorganization.

Repair of Sidewalks

At the recent Selectboard listening sessions, everyone agreed that the sidewalks in Norwich need repair. My sense, however, is the Town is paying little or no attention to sidewalk upkeep.

The Town has about $117,000 in a sidewalk designated fund. Also, in November 2017, DPW Director Andy Hodgdon estimated it would cost around $160,000 to repair all sidewalks in Town and proposed a six year plan to do so.* The budget in 2022 included money for TRORC to conduct a sidewalk inventory which apparently did not occur. In addition, a capital plan might reveal if any sidewalk repair work is penciled in the next six years. But as noted above, there is no capital plan.

Is it time for the Selectboard to develop a long-term schedule for sidewalk repairs?

Some public officials suggest the sidewalk issue is murky because the Norwich Fire District, a separate municipality, owns some of the sidewalks. That, however, is an excuse more than a justification for two reasons. First, the Town knows which sidewalks it owns. It owns about two-thirds of the three mile network of sidewalks. See the lists in the January 24, 2024, and November 15, 2017 Selectboard meeting packets. The latter list was posted on my blog here. Plus, Town sidewalks also need repair. Second, the Fire District would happily give its sidewalks to the Town. What’s more, the Selectboard voted on November 15, 2017, to accept “as is” the Fire District sidewalks. There was no follow-up to that vote.

Address $700,000 revenue hole in FY 2026

The Town proposes to use $700,000 in surplus funds to buy down the tax rate in the fiscal year ending in 2025. That’s good news for taxpayers this year, but poses challenges for tax rate stability in the subsequent year.

To elaborate, the $700,000 in surplus accumulated over several years and won’t be around the following budget year (fiscal year 2026). Consequently, tax revenue must increase to cover the revenue hole of $700,000. By my calculation, property taxes will need to increase by 14.7 percent, if the budget is flat in fiscal year 2026.** Taxpayers are generally not fans of double-digit increases in their property tax bills

Funding Raises Under a Union Contract

The proposed budget includes COLA increases in pay. The Town is in negotiations with the union on a contract that expired last July. Assuming the new union contract increases pay beyond COLA, funds to cover those raises are not in the budget. Some other line item or items will need cutting to make up the difference.

Total wages paid by the Town approaches $2 million. A five percent increase in wages adds $100,000 to expenditures, plus the Town’s share of payroll taxes and pension contributions.

Miscellaneous

Some other open matters include funding for Ash Borer expenses, adopting a police body cam policy, improving the Town’s website, and reviewing Zoom costs.

End notes

* Information about sidewalk repairs and the Rec Department budget is in the December 6, 2017 Selectboard meeting packet

** According to the latest financials, the Town collected $4,766,168.98 in property taxes to cover the annual budget, which is more than projected. The amount $700,000 is 14.69% of $4,766,168.98. A comparison of the tax rate won’t be an appropriate measure. The rate will likely decline because the value of the Grand List could increase by at least 20 to 30% due to the rise in real estate values.

* * *

Contact me at norwichobserver [at] gmail.com

Chris

Thank you for all this information. It is very helpful