The Norwich Selectboard finalized the property tax rate on Tuesday. The total rate for homestead property will rise 3.25% compared to last year, from $2.3591 to $2.4358. For non residential property, the total rate goes from $2.2696 to $2.3589, about a 3.9% increase. Those numbers are from the Selectboard packet for the July 6, 2021 meeting. See chart below.

At that meeting, Selectboard Chair Roger Arnold “thanked the Listers, Town Manager, and school personnel for their work on the tax rate,” say the draft meeting minutes.

By my calculation, the total tax bill for a $400,000 homestead property will be $9,743.20. That is an increase of about $307 from last year.

According to a listserv post by Town Manager Herb Durfee, tax bills will be mailed “no later than July 13, 2021. The first tax installment thereafter is due no later than 6:00 pm on Friday, August 13, 2021.”

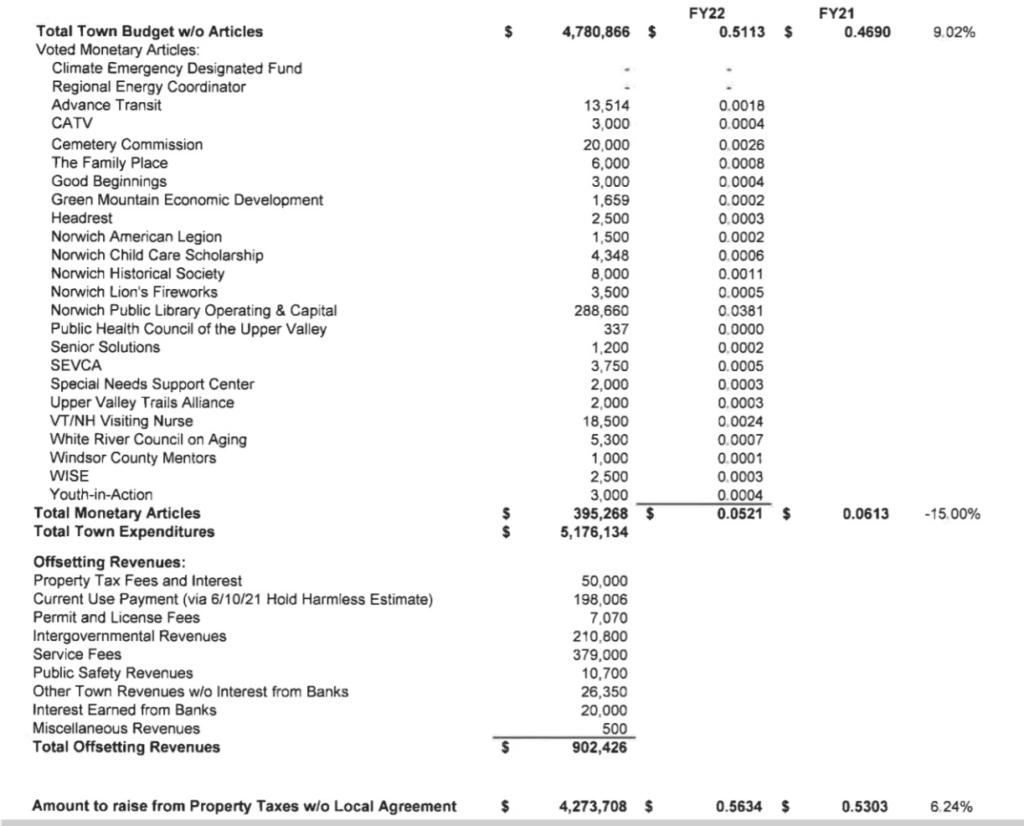

Further, the material in the Selectboard packet indicates that to cover just the Town budget, the town rate would need to increase by 9.02% from last year — to $0.5113 from $0.4690. The increase was dampened to 6.21%, mostly by a reduction in the amount raised by separate Town Articles and steady projected revenues. The school homestead rate rose by 2.42%.