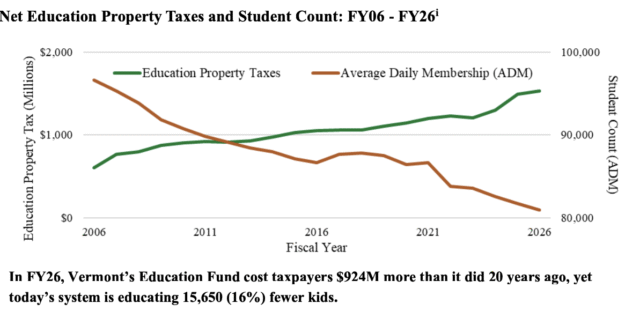

Spending More, Getting Less: Vermont’s Education Problem in Two Graphs

Sometimes a picture (or in this case, a graph) really is worth a thousand words. Two simple graphs tell you everything you need to know about an overlooked problem in Vermont’s education system. We are spending more but students are getting less. The Cost Crisis Over the past 20 years, Vermont’s education property taxes have increased by $924 million while the system educates 15,650 fewer students. Think about that: we’re spending a whole lot more to teach dramatically fewer (16% Continue reading Spending More, Getting Less: Vermont’s Education Problem in Two Graphs