The Norwich School Board recently took the first step in shaping next year’s budget by adopting its “2025-26 Norwich Budget Guidelines.” As these early discussions begin, many of us in town are already feeling the strain from this year’s nearly 17% increase in school property taxes. Unfortunately, it is not going to get better. While Vermont’s funding system aims to promote a fairer distribution of resources across all schools, the reality is that some of us are left questioning how much longer we can afford to stay in our community.

The School Board is mindful of the tax burden and seeks community input, with past discussions of budget matters being open and transparent. It is also understandable that the Board wants to maintain educational quality and does not want to make drastic cuts (and it cannot for Dresden). However, if the current tax trend continues, Norwich risks becoming unaffordable for some long-time residents. In addition, moving to Norwich ‘for the schools’ could become a form of ‘school choice’ only available to wealthy families.

In its last season, the Legislature created the Commission on the Future of Public Education to study the problem. That would total 16 studies since 2006, according to Karen Horn’s August 14 opinion piece in VTDigger. Education and its funding is a complex issue involving competing interests across the state. While everyone agrees it is time to make some hard choices, the question remains: will the Legislature act? Double-digit increases in spending across the state are unsustainable.

State Senate and House seats are up for election this Fall. It’s crucial to ask tough questions of candidates. Don’t be satisfied with vague or general responses.

The Good News

First, let’s start with what looks positive in the Budget Guidelines. For Marion Cross School, the School Board’s goal is a zero percent increase in the operating budget. That will necessitate some cuts. Overall, the Budget Guidelines recommend “a 2025-26 total budget increase of between 1.5% – 2.0%.” That modest increase does not account for any increase related to new union contracts for teachers and support staff. Those expire on June 30, 2025.

Nor does it include the Dresden Assessment for students in grades 7-12, which constitutes about 50% of total school expenditures by Norwich. The Dresden School Board has not yet adopted budget guidelines, although a preliminary draft aims for a flat budget. Hanover holds a majority of the seats on the Dresden School Board. The Norwich Budget Guidelines note: “The Norwich School Board appreciates the willingness of our Hanover colleagues to consider limited budget increases to help lessen the anticipated tax rate increase in Norwich.”

This year’s Marion Cross School adopted budget grew by 9.66%. At the time of Town Meeting 2024, the Dresden Assessment (including separate articles) projected to grow by less than 1%. It would seem, therefore, that the MCS budget is the main driver of increased spending in Norwich, even though statewide spending influences the tax rate.

The Challenges Ahead

However, the Budget Guidelines note a number of factors that might influence the budget and taxes, the majority related to the State’s byzantine system for funding education. I discuss these from a taxpayer’s perspective below.

Excess Spending Penalty.

Starting next year, the Legislature reinstated the excess spending penalty that had been repealed. The Budget Guidelines predict that without “substantial reductions in spending or a significant increase in students, Norwich will incur the excess spending penalty in FY26.” This penalty doubles the tax on education spending above a set amount (118% of the statewide average of per pupil spending).

It will bear watching what the exact impact of this penalty is on Norwich taxpayers. And the dollar amount in cuts needed to avoid the penalty. Last year, the School Board chose not to increase class size at MCS, even though the resized classes remained within Norwich’s internal guidelines.

Of note, the penalty does not take into account that Norwich does not control the Dresden School District budget. Notably, Norwich is not the only Vermont town that shares a school district with neighboring towns. However, there is an important distinction – Hanover is not subject to the same property tax system as Norwich. Maybe it is worth looking at legislation acknowledging this distinction.

Phasing out of Act 127 transition.

Under Act 127, Norwich lost 19% of its pupil count (highest in the State) as a result of the change in the weight accorded to individual students based on certain socioeconomic factors. To ease the transition, the Legislature hastily adopted a discount in the homestead tax rate to towns losing pupil count. The transition provision phases out over a five-year period. Next year, the discount is 20% less.

By my calculation, the discount allocated to Norwich, saved a taxpayer with a $400,000 home, over $1000 in property taxes at the homestead rate.

Also the municipal tax rate was reduced this year by application of a $700,000 surplus. That surplus is not necessarily available again. Thus, an increase in municipal taxes beyond the CPI seems likely..

Increase in the Common Level of Appraisal (CLA).

The town-wide reappraisal is expected to be complete by next year, resulting in a CLA of around 100%, up from 67.57%. The Budget Guidelines suggest that increased assessed values will lead to increased tax bills. This may not be true across the board. The CLA affects the property tax rate, not your property tax bill, as the Public Assets Institute explained here and in the inset.

https://publicassets.org/blog/the-new-and-improved-cla/

Surging home prices alone do not directly increase property tax bills. Tax bills are influenced by multiple factors, including spending levels and the overall tax system.

The CLA often gets the most attention as it is designed to ensure uniformity in property tax assessments from town to town across the state – that is, inter-town equity. However, individual property owners in a town may want to pay closer attention to another number, the Coefficient of Dispersion (COD). Because not all properties increase in value at the same rate, the COD measures fairness within a Grand List – intra-town equity.

With a COD of 22, many homes in Norwich are currently not assessed equitably. As a result, some property owners are paying more (or less) than their fair share of taxes. A town-wide reappraisal should even numbers out. But some property owners may see a significant increase in their tax bills afterwards, particularly if they were previously paying less than their fair share in municipal and school taxes.

State mandated cost containment.

A final report by the Commission on the Future of Public Education is not due until December 2025. However, by December 15, 2024, the Commission is to make short-term cost containment recommendations to the Legislature. That is an ambitious schedule as its Education Finance Subcommittee of the Commission first met on September 4.

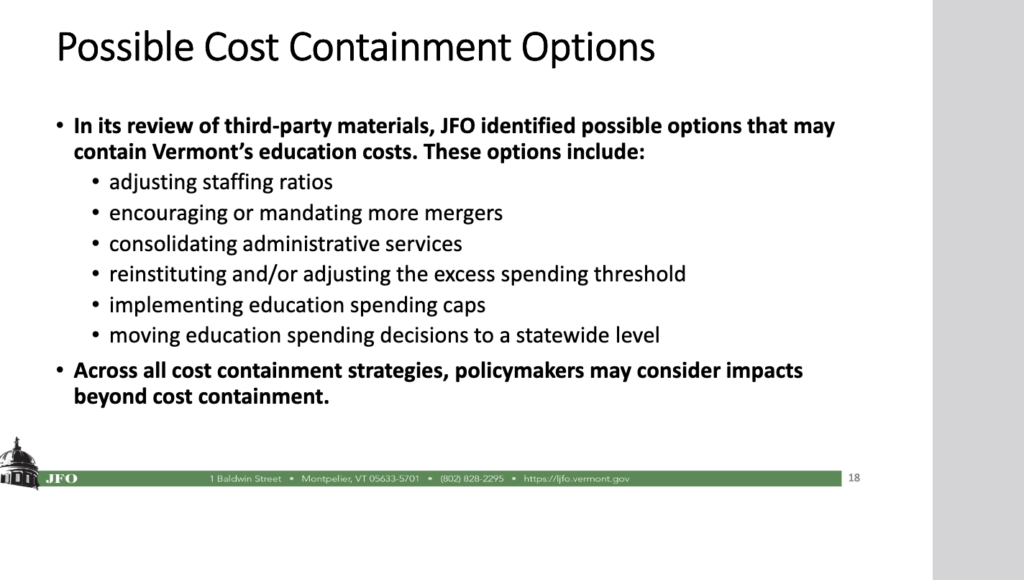

The Vermont Legislative Joint Fiscal Office (JFO) listed several possible cost containment options in its January 2024 presentation to the House Committee on Ways and Means. See below.

Notably, Vermont has the lowest student-staff ratios in the United States, 4.4 enrolled pupils per staff. But I cannot see the Legislature dictating student to staff ratios, when it would mean firing teachers. To my layman’s eye, the only viable ‘short-term’ containment measures on the JFO’s list are hard spending caps or greater excess spending penalties. These would have a significant impact on Norwich. I also wonder about the wisdom of such blunt measures, if they penalize quality education.

In addition, I saw an interesting proposal made in April by the Vermont School Boards Association, Vermont Superintendents Association, Vermont Principals Association and Vermont Association of School Business Officials. They recommended statewide bargaining of teachers contracts, with adjustments for regional cost of living. At present, health insurance is set statewide. There was also the suggestion that state initiatives contributed to excess spending, putting some of the onus on the Legislature for excess spending.

Tax rates set by the State.

Tax rates to fund education are set by the Legislature and are dependent on the total spending by all school districts. Local budgets, statewide taxes. Homestead tax rates are determined by the Legislature setting the “yield,” a determination too complex to explain in one paragraph. Thus, local spending decisions in Norwich do not directly affect the Norwich homestead rate. For example my homestead property tax bill increase by nearly 17% but overall net education spending for Norwich only increased by 5.64%. See Exhibit 2.8 and Exhibit 3.V.10 of the Norwich budget presentation. It is the spending by all districts that determine rates, which creates challenges for the Norwich School Board.

Further, calculating the “yield” may appear formulaic but the inputs depend heavily on political decisions by the Legislature. Last year the Legislature decided to not increase the non-homestead rate and limited the increase to residents paying homestead taxes based on income. The State also added to sales and use taxes and applied $69 million in surplus to reduce taxes.

Additions to the budget.

Notwithstanding the 0% increase goal, the Budget Guidelines mention several areas that require further consideration, including improvements to MCS and the hiring of a shared clinical social worker. See inset below.

• Resources in support of strategic plan initiatives. Significant work was completed in the development of the strategic plan. The board would like to understand the budgetary implications of the top strategic plan initiatives.

• Clinical social worker. The administration has indicated that a clinical social worker shared among the four district schools could be beneficial. The board would like to understand the cost implications and benefits of hiring this position.

• Facility needs. The board would like to understand what facility improvement or maintenance items are recommended.

• Sustainability work. The Board would like to consider initiatives that will help the district meet its sustainability goals.These items are clearly worthy of examination, as they add value. However, they may add to the budget. During a time of fiscal constraint, it is crucial to differentiate between wants and needs.

Other Considerations

I want to mention three other topics not directly related to the Budget Guidelines but worthy of note and perhaps further discussion.

Sixth grade to Richmond Middle School?

At the September 4 Norwich School Board meeting, preliminary discussions occurred regarding the possibility that Norwich sixth-graders are better served attending the Richmond Middle School (RMS). Long-time residents may recall that at the time RMS was built, Norwich educators made the deliberate decision that the Norwich sixth grade was better off staying at Marion Cross School. Times and education needs change. However, as noted above, it is vital to distinguish between budget needs and budget wants, particularly during a time of double digit tax increases.

Added cost of Clean Heat Standard

Coming into sharper focus is the added cost of heating oil and propane, if the Legislature moves forward this session on the Clean Heat Standard. Of concern is the cost estimates in the expert’s report recently released by the Department of Public Service. Extrapolating from that report, added costs are estimated “to range between $1 to $4 per gallon to reach the current targets” said Democrat Senator Thomas Chittenden on his Facebook page on September 8. Republican commentator Robert Roper reached a similar conclusion on his substack.

https://robertroper.substack.com/p/will-vt-lawmakers-drive-up-heating

These numbers are sure to impact school budgets, including that of MCS which shifted to propane this year.

Further, there is only so much a family budget can absorb in school taxes and hearing bills.

Efficacy of Act 127

I have been wondering about the efficacy of Act 127, the legislation that made multiple changes to pupil weights in Vermont’s education funding formula. Act 127 is said to “increase the tax capacity” of school districts in need. But there are no rules about how to use the tax capacity. A district could pass some of the savings on to local taxpayers by not adding to the budget.

By way of example, the Rivendell Interstate School District saw its Act 127 pupil count increase by 16% and its net education spending declined by 1%. As result, the Town of Fairlee, the largest member of the district, saw its homestead rate drop by 20%. Although multiple of factors are involved, it would seem, to my untrained eye, that taxpayers not students were the beneficiaries of Act 12. Is that a feature or a bug of the law?

Another example is the pupil weight assigned under Act 127 for English learner (EL) students. It assumes, that the average additional cost for educating an EL student in Vermont is about $22,947. See Report on the Additional Cost of Educating Vermont’s English Learner Students at 5. What if a school district does not spend that much on its EL students or nothing extra at all? Are categorical grants more appropriate than student weights, as suggested by this 2021 article of the Public Assets Institute?

I do not know the answers but have not seen the efficacy of Act 127 discussed. Maybe I am just thick.

[END]

* * *

Comments to this post are welcomed, below or by email. Even better, contact your local or state officials.

Contact me at norwichobserver[at]gmail.com