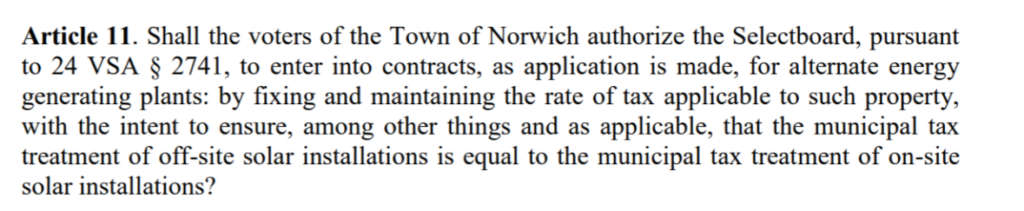

The text of Article 11 is convoluted. However, its intent is clear – to eliminate municipal property taxes on solar farms. The Energy Committee’s recommendation to the Selectboard says it wants “to set their municipal taxes as close to $0 as possible.”

To what end? The most important question to ask about a tax break is whether it will make a difference.** Will the tax incentive cause a developer to build a solar farm, when it would have otherwise passed on the project?

We don’t know because neither the Selectboard nor the Energy Committee addressed the topic. Solar projects get a 30% tax credit and net-metering credits, plus State mandated discounts on municipal and school property taxes†. All of us pay for those subsidies.

What analysis supports the proposition the another tax break will create more solar in Norwich? If the tax break is not an incentive to build, then it is just a gift.

And, if the incentive means more solar for Norwich, does that result in less solar in Hartford, Thetford or Windsor. Are we poaching a project destined for Hartford, but for the Norwich tax incentive?

One possible response is that the municipal tax break by Norwich is too small to influence a developer’s behavior. If that be the case, then it is a gift.

Another issue to explore is the impact of the March 2020 Town Plan on large scale solar. That Plan contains the most liberal siting standards in the State for net metering solar projects. As a result, to my chagrin, the Town Plan excludes the community from solar siting decisions on undeveloped land. I am thinking that we should give that provision time to work its magic before adding another incentive.

Also, a question to explore is whether Norwich is doing enough to encourage large scale solar development in Norwich, if that is what we want. I tip my hat to the Energy Committee for its work on residential solar. However, I don’t know what can be done or has been done to promote community or commercial solar projects.

End Notes

** For a general discussion of property tax incentives, see The Effective Use of Property Tax Incentives for Economic Development (2013) at the website of the Boston Fed.

† State property tax breaks. Under State law, the the first 50 kW of the project are exempt from municipal property taxes. The remainder of the project receives a 30% reduction in value on the Grand List. Moreover, “[s]olar plants subject to the [Uniform Capacity Tax (UCT)] are exempt from the statewide education property tax,” says a webpage of the Department of Taxes. The UCT is $4.00 per kW of plant capacity. The non-residential tax rate in Norwich last year was $1.7290. By my calculation, the project at Route 5 North is paying nearly $6500 less per year in school taxes, because of the UCT.

Never miss a new post on the Norwich Observer. Subscribe to my blog by submitting your email address in the subscribe box in the right column above. Thanks!

Thanks for writing about this Topic and Article 11 Chris.

I’m not sure what’s more disturbing, the purposeful confusing verbiage to get voters to “tick” yes or the fact that the Town is ok with doling out real estate tax breaks to “for profit” solar fields. Out of state investors are using this solar fields as tax vehicles and now we are asked to subsidize that with real estate tax breaks because our NEC and SB deem it appropriate? Furthermore a current SB member who works in the solar industry, knows the out of state investor, worked for the solar company in question, crafted the article. Now that it disturbing. Conflict of interest anyone? anyone?